Strategic Business Consulting | Minority Business Development Agency

Blog | Harvard Professional Development | Harvard DCE

General & Specific Business Consultancy | Kamyar Shah

15 Ways To Onboard New Hires Efficiently (Even During Busy Times)

Create A Complete Feedback Loop

One of the rather easy ways to evaluate and improve onboarding, be it in a high- or low-stress environment, is having a complete feedback loop with all stakeholders. This would allow for feedback from all levels, including the new employee. This kind of dynamic feedback allows for quick tactical pivots to improve the onboarding quickly and effectively. – Kamyar Shah, World Consulting Group

by Kamyar Shah – Interim COO

15 Tips For Tactfully Turning Down A Potential Client

Stick To The Facts

Polite and factual statements are virtually always the best way of approaching most conversations, even the difficult ones. In this particular instance, it is just as important what is being said as how it is said—conveying that a relationship may not be as productive and effective while encouraging them to find alternatives would be the optimal approach. – Kamyar Shah, World Consulting Group

By Kamyar Shah – Interim CMO

15 Tips For Navigating Family Business Challenges

Keep Family Issues Out Of The Business

Though there are many different ways that may help avoid family pitfalls, one of the safest ways is a clean-cut separation of family and business. Creating a formal separation in which personal and family issues do not carry any merit when it comes to business-related matters will have the best chance for long-term success. Alternatives are more susceptible to occasional and repeated failures. – Kamyar Shah, World Consulting Group

Check out my Part-time COO and/or Part-time CMO services

Overwhelmed? 15 Ways To Set Better Boundaries For Work And Life

Enforce The Consequences Of Your Boundaries

Boundaries are less about explicit expression than actions. For boundaries to be of any impact, there have to be consequences that are obvious enough. Those actions and consequences can be as simple as making sure the other side notices that they have been ignored on purpose, or as complex as explicitly and publicly emphasizing that they have been ignored for a specific reason. – Kamyar Shah, World Consulting Group

Check out my Business Consulting and/or Management Consulting services.

Keep Your Stakeholders In The Loop With These 14 Communication Tips

Operate With Consistent Integrity

Though communication is the obvious answer, there is more to it. Communication at its face is great; however, in order to have the proper impact on stakeholders, those communications have to be above board. That usually translates into being accepted as a person of consistent integrity that will report objectively at all times. Without that perception, communication is not effective. – Kamyar Shah, World Consulting Group

By Kamyar Shah – Chief Operating Officer

Financing Your First Business? 16 Expert-Recommended Funding Tips

Seek To Self-Fund First

Though there are many tools and platforms that make fundraising more accessible, there is still a lot to be said about self-funding. A self-funded company tends to signal several positive attributes that are highly desirable, including self-discipline. Though this may not apply to all business environments, it should be the first option to be considered. – Kamyar Shah, World Consulting Group

By Kamyar Shah – Chief Marketing Officer

12 Up-To-Date Lead Generation Tips For The Modern Salesperson

Look In ‘Little Ponds’

The simplest way to exponentially grow inbound leads in later stages of a business is to adopt the “big fish, little pond” methodology. Secondary venues, or “little ponds,” that are unlikely to be overcrowded by others will allow the business to be the “big fish.” This approach, however, requires an immense amount of creativity and experimentation to find the proper and converting “little ponds.” – Kamyar Shah, World Consulting Group

By Kamyar Shah – Read more about Management Consulting & Operations Management

Job Seekers: 13 Important Things To Look For In Your Ideal Recruiter

What They Do With The Information You Provide Them

Much like any other service provider, recruiters depend a great deal on information to provide the best possible result. Hence, it is important to be proactive and provide them with a complete background as well as a “narrative” of what you are trying to accomplish. The more details and guidance one provides, the more likely that the recruiting efforts will result in the desired outcome. – Kamyar Shah, World Consulting Group

By Kamyar Shah – Remote COO

Is Your Company Growing Too Fast? 14 Red Flags To Watch For

You’re Putting Out Daily Fires

Rapid growth entails change, which tends to create friction. That sort of friction tends to manifest in a wide range of symptoms such as quality control issues, customer dissatisfaction as well as internal conflicts. Those symptoms are just that—symptoms. The underlying causes are virtually always within growth and scaling projects that were not planned or not executed properly. – Kamyar Shah, World Consulting Group

By Kamyar Shah – Remote CMO

15 Culture-Building Tips For An All-Remote Team

Encourage Cross-Collaboration

As someone that has worked 16-plus years remotely, the single most important cultural tool is cross-collaboration. Remote teams that integrate cross-collaboration among team members tend to create deeper and more personal relationships. It ultimately tends to translate into deeper personal bonds that not only help maintain but also evolve the organizational culture. – Kamyar Shah, World Consulting Group

By Kamyar Shah – Business Consultant

How to Become a Financial Auditor

How to Become a High School Administrator: Education and Career Roadmap

How to Become a Travel Consultant: Career Roadmap

How to Become an Insurance Claims Examiner

How to Be a Celebrity Manager: Education and Career Roadmap

How to Become a Casino General Manager: Education and Career Roadmap

How to Become a Music or Band Promoter

How to Become an Account Manager: Education and Career Roadmap

How to Become a Boxing Promoter: Education and Career Roadmap

Become a Bridal Consultant: Education and Career Roadmap

America's Best Startup Employers

America’s Best Employers By State

Meet America’s Best Management Consulting Firms 2020

Families First Coronavirus Response Act: COVID-19 Update

In its second month, the coronavirus crisis is tightening its grip on the U.S. economy, spurring the Trump administration and Congress into taking bold actions to mitigate the damage. In just the last week, Congress has passed two critical pieces of legislation referred to as “Phase 1” and “Phase 2” of its coronavirus response. Congress is now considering a massive $1 trillion Phase 3 package to inject cash in an attempt to keep the economy from cratering.

Phase 1 was an $8.3 billion Act designed to shore up the country’s health care response capabilities, including additional funding for vaccine research and development.

Phase 2, which was passed by the House last weekend and approved by the Senate and signed by the President on Wednesday, is a $100 billion package targeting workers and families. The Families First Coronavirus Response Act provides financial relief for workers and businesses impacted by the virus and the economic fallout.

Phase 3 will be an ambitious stimulus package designed to inject cash into the economy through direct payments to individuals and financial support for small businesses. The Phase 3 stimulus package is currently being crafted in the Senate.

Tax credits help fund sick, family and medical leave

The Phase 2, Families First Coronavirus Response Act, ensures that sick, family, and medical leave payments are available for workers and families impacted by the virus. To that end, the Act provides small businesses with various refundable tax credits to help offset qualified paid sick leave and family leave wages paid by an employer.

The Act also provides eligible self-employed workers and those caring for a family member with a refundable tax credit against income taxes equal to 100 percent of a qualified sick leave equivalent. For individuals caring for a family member or for a child whose school or place of care has closed due to coronavirus, the Act provides a refundable tax credit equal to 67 percent of a qualified sick equivalent amount.

For employers, the tax credit is allowed against the employer portion of Social Security taxes (Code Sec. 3111(a)).

To cover leave costs, small businesses will be allowed to tap into cash they have on deposit with the IRS. For small businesses that don’t have a sufficient amount of cash deposited with the IRS, the Treasury will advance funds so those businesses can cover those costs.

For specific guidelines please see Journal of Accountancy article.

Questions? Concerns? You don't have to go at it alone

It’s important to note that these are temporary measures to provide targeted and immediate relief to individuals, families, and businesses impacted by the coronavirus. Our staff stands ready to answer your questions and provide any guidance you need during this difficult time.

About The Author

Steven G. Albert, CPA, MST

Tax Partner | Shareholder, Managing Director, Tax Services Learn More>>

Please consider sharing this post

The post Families First Coronavirus Response Act: COVID-19 Update appeared first on Glass Jacobson Financial Group.

Hogan Executive Order Closes Maryland Non-Essential Businesses

March 23, 2020: Governor Hogan issued an order, effective at 5:00 p.m. today, closing all Maryland non-essential businesses. Click here to view the guidance with a non-exhaustive list of businesses, organizations, and facilities that may remain open.

For more information regarding coronavirus for Maryland businesses, go to https://businessexpress.maryland.gov/coronavirus.

About The Author

Steven G. Albert, CPA, MST

Tax Partner | Shareholder, Managing Director, Tax Services Learn More>>

Want to RECEIVE COVID-19 UPDATES?

Enter your email below and we'll keep you updated!

Please consider sharing this post

The post Hogan Executive Order Closes Maryland Non-Essential Businesses appeared first on Glass Jacobson Financial Group.

Maryland Small Business COVID-19 Emergency Relief Loan Fund

Gov. Larry Hogan announced Monday that Maryland has authorized $130 million in loan and grant funding for small businesses, non-profits and manufacturers that have been negatively impacted by the Coronavirus (COVID-19).

These funds can be used by businesses/organizations that demonstrate financial stress or disrupted operations (defined below), and can be used to pay cash operating expenses including payroll, rent, suppliers, fixed debt payments and other mission critical cash operating costs.

If you are a Maryland-based business impacted by the Coronavirus with under 50 full- and part-time employees, check out the programs below to see if you qualify for assistance

Maryland Small Business COVID-19 Emergency Relief Loan Fund

This COVID-19 Emergency Relief $75M Loan Fund offers working capital to assist Maryland for-profit small businesses with financial stress due to COVID-19. This program is designed to provide short term relief.

Terms and conditions

- Loans up to $50,000 (not to exceed three months of cash operating expenses) open to Maryland businesses impacted by the COVID-19 with fewer than 50 employees.

- 0% for the first 12 months, and 2% for the remaining 36 months.

- Deferral of any payments for the first 12 months, and straight amortization beginning in the 13th month through the 36th month.

- Business must be established prior to March 9, 2020 and in good standing.

- Applicants must have employees on their payroll for whom they have had payroll taxes withheld (i.e. W-2 employees).

- Two years of historical financial statements and most recent interim statement to benchmark revenue against (if available).

- Six month pro forma of estimated lost revenue or other documented loss evidence.

- Minimum personal credit score of 575.

- No collateral requirements.

- Eligible uses include: working capital to support payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of operations.

The business must demonstrate financial stress or disrupted operations, which may include but are not limited to:

- Notices from tenants closing operations and not paying rent caused by loss of income.

- Notice of inability to pay rent or make loan payments due to reduced sales, suspended operations.

- Increased cost related to COVID-19 prevention measures.

- Notice of disrupted supply network leading to shortage of critical inventory or materials.

- Other circumstances subject to review on a case by case basis.

How to apply

After verifying that you qualify to apply for the loan, click here to apply.

Additional Information

To learn more about the MD Small Business COVID-19 Emergency Relief Loan Fund click here.

Maryland Small Business COVID-19 Emergency Relief Grant Fund

This COVID-19 Emergency Relief $50M Grant Fund offers working capital to assist Maryland small businesses and nonprofits with disrupted operations due to COVID-19.

Terms and conditions

- Grants up to $10,000 not to exceed 3 months of cash operating expenses for Maryland businesses and nonprofits impacted by the COVID-19 with 50 or fewer employees.

- Must be established prior to March 9, 2020.

- Business must be in good standing.

- Applicants must have employees on their payroll for whom they have had payroll taxes withheld (i.e. W-2 employees).

- Annual Revenues of the business or nonprofit not to exceed $5 million as evidenced by Financial Statement or other financial documentation.

- Business or nonprofit is expected to seek longer term funding through its bank, SBA, or other source.

- Eligible uses include: working capital to support payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of operations.

The business or nonprofit must demonstrate financial stress or disrupted operations, which may include but are not limited to:

- Notices from tenants closing operations and not paying rent caused by loss of income.

- Notice of inability to make loan payments due to reduced sales, suspended operations.

- Increased cost related to COVID-19 prevention measures.

- Notice of disrupted supply network leading to shortage of critical inventory or materials.

- Other circumstances subject to review on a case by case basis.

How to apply

After verifying that you qualify to apply for the loan, click here to apply.

Additional Information

To learn more about the Maryland Small Business COVID-19 Emergency Relief Grant Fund click here.

Want to RECEIVE COVID-19 UPDATES?

Enter your email below and we'll keep you updated!

Please consider sharing this post

The post Maryland Small Business COVID-19 Emergency Relief Loan Fund appeared first on Glass Jacobson Financial Group.

What the CARES Act Means for Your 401(k) and IRA

The Senate unanimously passed a $2 trillion stimulus package on March 25 that will help individuals and businesses devastated by the coronavirus. It is now being finalized in the House and a vote is expected March 27.

Here are some provisions that will be critical to investors should the bill pass:

Early 401(k) and IRA Withdrawals

The bill allows affected individuals under the age of 59 ½ to take withdrawals from their qualified retirement plans (401k, IRA, etc.) without incurring the Sect 72(t) penalty of 10%, up to $100,000. However, the exception only applies to:

- An individual who is diagnosed with SRS-COV-2 or COVID-19 by a test approved by the CDC,

- whose spouse or dependent is diagnosed with one of the two diseases, or

- who experiences adverse financial consequences as a result of being quarantined, furloughed or laid off or having work hours reduced, or being unable to work due to lack of child care.

While the distribution is exempt from 10% penalty, it doesn’t escape income tax. The Act, however, allows the taxpayer to spread the income over a 3-year period beginning in 2020. The taxpayer can also avoid any income recognition by repaying the distribution to the retirement plan within three years of receiving it.

While this may seem like a good idea initially, we would not recommend this as your first option. You may avoid the 10% penalty, but you still owe taxes. We suggest taking advantage of any stock market losses you have incurred in your taxable investment accounts. The strategy you can employ is called tax loss harvesting.

Tax Loss Harvesting

Tax loss harvesting is the practice of selling a security that has experienced a loss and by realizing, or "harvesting" a loss, investors are able to offset taxes on both gains and income. Depending on how much cash you need, you will want to coordinate the sale of your investments with your overall asset allocation strategy.

401(k) Loans

Another option to consider before withdrawing money out of your 401k is a 401k loan, if your plan allows it. If it doesn’t, the legislation allows for plans to adopt it immediately. With a 401(k) loan, you won’t owe income tax on the amount you borrow, assuming you pay back the loan within five years. Note, you will have to pay back the funds with after-tax dollars.

Moreover, if you leave or lose your job, you may be required to pay back the balance early. If you are unable to pay it back you you will owe taxes and possibly an early-withdrawal penalty. You also have to pay interest on the loan, but are effectively paying the interest to yourself.

With all these options it can be difficult to determine the best option to generate short term cash needs. Our financial advisors and tax professionals at Glass Jacobson are here to help you make the best decision for you and your family.

Waiving Required Minimum Distributions for 2020

Typically, you are required to take your RMD by April 1 of the year that you turn 70 ½ and by the end of each subsequent year. The recently passed Secure Act extended the age to 72 but if you turned 70 ½ last year you are still required to take your 2020 RMD.

If the CARES Act passes, you have the option not to take your 2020 RMD. This could be a much-needed relief for investors as markets may be slow to recover from the steep decline in recent weeks. RMDs are calculated based on Dec 31 values of the previous year which in 2019 put the DOW around 28,000. You would be calculating an RMD based on values that have disappeared in recent weeks resulting in a very large distribution.

Want to RECEIVE COVID-19 UPDATES?

Enter your email below and we'll keep you updated!

Please consider sharing this post

The post What the CARES Act Means for Your 401(k) and IRA appeared first on Glass Jacobson Financial Group.

CARES Act Signed into Law: What this 800+ Page Bill Means for You

The CARES (Coronavirus Aid, Relief, and Economic Security) Act, passed by the Senate on Wednesday and the House of Representatives earlier today, has now officially been signed into law by President Trump.

The Act represents the most expensive economic aid package in American history, more than doubling the stimulus bill passed during the 2008 Great Recession.

With more than 800 pages worth of stimulus measures, the CARES Act will attempt to curb the economic crisis that the coronavirus outbreak has caused, and will provide $2.2 trillion in economic aid.

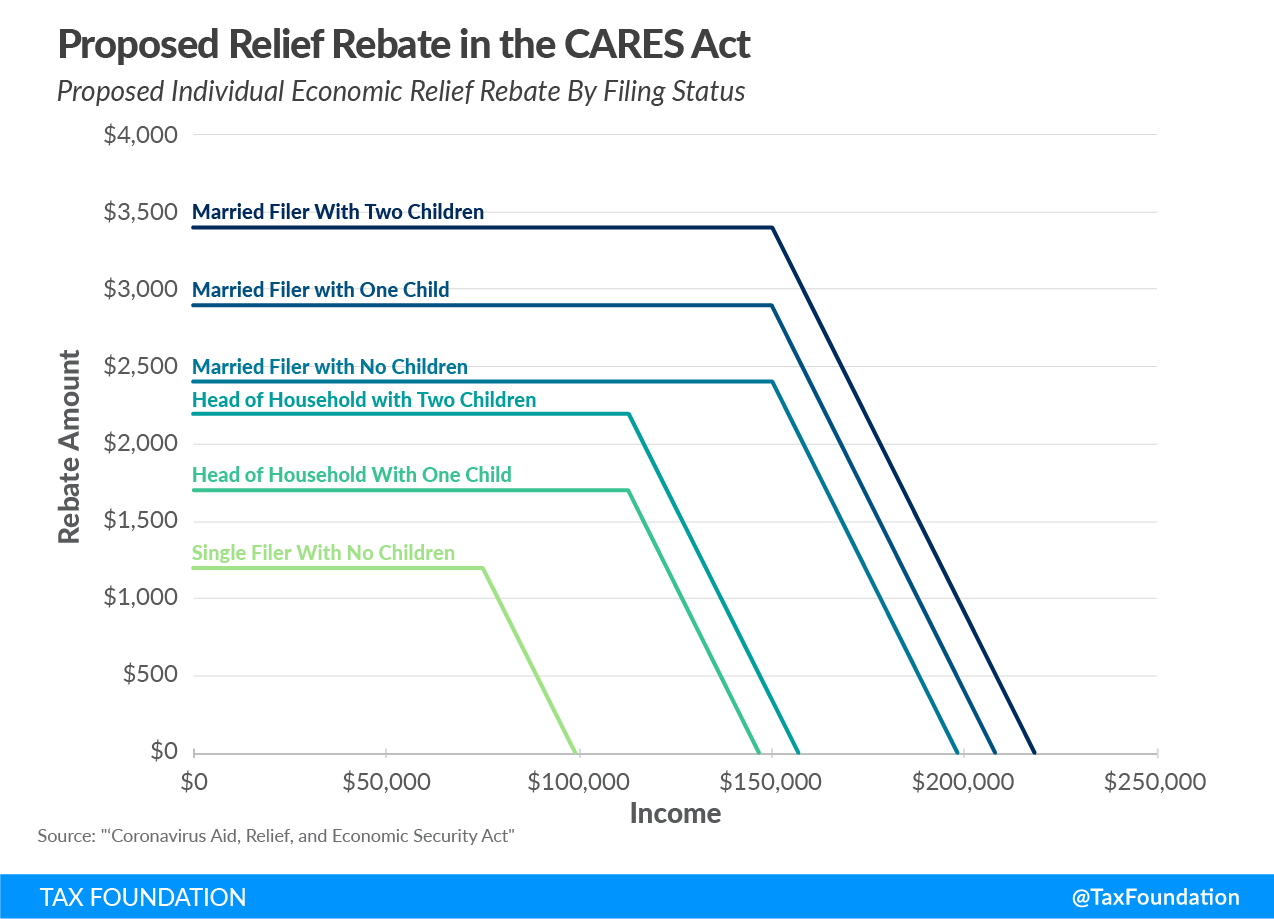

Recovery Payments for Individuals

Under the new bill, most Americans, working or not, will receive checks up to $1,200. Married couples are eligible for up to $2,400, with an extra $500 for each dependent they have.

The amounts begin phasing out above certain income levels. For individuals, the phase-out range is $75,000 to $99,000. For married couples, the range is $150,000 to $198,000. There are provisions that may allow you to qualify if your 2020 income falls below your 2018/2019 income level.

These refundable tax credits are expected to be direct deposit (if that’s how you received your tax refunds) or checks if you did not provide direct deposit info on prior tax returns.

Unemployment Assistance

Besides potentially getting cash payments in early April, unemployed Americans will receive additional benefits. Groups that normally don’t qualify for unemployment benefits—freelancers and furloughed workers—will qualify under the new plan.

The maximum amount that each state hands out to unemployed workers every week will increase by $600, thanks to funding from the federal bill, for up to 4 months.

Small Business Assistance

Small businesses (500 employees or less) will get $367 billion in forgivable loans to help meet payroll, health insurance, rent, mortgage interest and utility expenses. Loans may be forgiven if a firm uses the loan for payroll, interest payments on mortgages, rent, and utilities and would be reduced proportionally by any reduction in employees retained compared to the prior year and a 25 percent or greater reduction in employee compensation

Confused? Schedule a free consultation with a Glass Jacocbson small business CPA.

The maximum loan amount is $10 million. The exact amount is based on previous payroll records. The interest rate is capped at 4%, and the origination process for one of these special loans will be expedited.

Additionally, small businesses may qualify for a refundable payroll tax credit of a varying amount, depending on the number of employees.

To keep up to date on when these programs become available, stay in

contact with your local Small Business Administration District Office, located here.

For more details on these small business loans, click here.

For additional resources, check out additional COVID-19 Resources for Small Business Owners.

Tax Advantages

In addition to helping small businesses with funding, there are some tax benefits included in the Act. Some changes include modifications to the Net Operating Loss (NOL) limitations and carryback rules, Qualified Improvement Property is now eligible for 100% bonus depreciation, and the business interest limitation has been increased.

Student Loans

The new bill, which is equivalent to half the government’s annual budget, hasn’t forgotten about students. They can postpone payments on loans for up to 6 months and still retain their Pell grants. Interest that accrues during a payment suspension will be waived.

If students don’t spend the money they receive from loans or Pell grants, they can keep it. Moreover, students who leave school because of the pandemic won’t lose eligibility for Pell grants in the future.

Retirement Accounts

The Act also includes changes to retirement distribution rules, including suspension of the early withdrawal penalty and Required Minimum Distributions (RMD).

For more information, read: What the CARES Act Means for Your 401(k) and IRA.

Evictions and Foreclosures

Borrowers who have federally backed mortgages will have 60 days of forbearance (delay in foreclosure), starting from March 18th. The 60-day period increases to 90 days for multi-family properties. Owners of such properties who receive forbearance cannot charge late fees or evict tenants during the grace period.

The bill grants up to 6 months of forbearance to homeowners who have economic difficulties due to the epidemic and who have federally backed mortgages purchased by Fannie Mae, Freddie Mac, or insured by HUD, VA, or USDA. Individuals must apply with their applicable mortgage servicer to take advantage of this provision.

Health Care

Over $100 billion of the $2.2 trillion will be used to fund health care services. This is a massive increase over the original $15 billion in the first draft of the bill.

Funds will be sent to hospitals, the Centers for Disease Control and Prevention, child nutrition services, and public transportation.

Will the CARES Act be enough?

Despite the stimulus bill’s enormous size, economists along with Treasury Secretary Mnuchin have cautioned that the CARES Act can only keep the economy afloat for a few months, given the far-reaching consequences of the epidemic. How much more the U.S. government is willing and able to spend is unknown at this time, but is a question that may eventually have to be answered.

Still have questions?

If you need help figuring out how this lengthy bill affects you, email our Coronavirus Response Team at cvrt@glassjacobson.com or schedule a free consultation below.

Want to RECEIVE COVID-19 UPDATES?

Enter your email below and we'll keep you updated!

Please consider sharing this post

The post CARES Act Signed into Law: What this 800+ Page Bill Means for You appeared first on Glass Jacobson Financial Group.